Geography/Environmental Studies 339

International Incentive-based Mechanisms for Reducing GHG Emissions

Learning Objectives

By the end of this chapter, you will be able to:

- Describe how each of the four international incentive-based programs to reduce greenhouse gas emissions within the UNFCCC operate;

- Outline the advantages of these programs compared to programs simply working within individual nations;

- Outline the challenges that these programs face in terms of providing sufficient incentives, monitoring requirements, and equity of outcomes; and

- Explain how these programs may change with the implementation of the Paris Agreement.

Introduction

Incentive-based approaches to conservation provide financial incentives for actions that support conservation goals. For example, a water utility can pay farmers within the watershed supplying its water to maintain a certain land cover to protect water quality. This is an example of a “payments for ecosystem services” (PES) program. Here is another example: an emissions-trading system can be set up to reduce the production of sulfur dioxide (SO2) from power plants by providing cleaner power plants with payments (for pollution emission allowances) from power plants for which pollution reductions are more costly. In both cases, actors (farmers or power plant operators) are being paid for behavior that is environmentally advantageous. As has been discussed in class, these programs are seen to have the potential to reduce environmentally harmful activities at lower economic costs compared to “one size fits all” forms of environmental regulation.

As was described in the previous chapter on International agreements to mitigate greenhouse gas (GHG) emissions, three “flexibility mechanisms” were added to the Kyoto Protocol at the urging of the United States. These provide greater flexibility to Annex 1 countries to meet their reduction obligations, by allowing them to take credit for funding reductions in other countries at lower economic cost. Emissions trading allows those actors (power plants, factories, etc.) that reduce GHG emissions to sell emission allowances to actors in other countries. In addition, “flexibility mechanisms” include project-based programs that allow industrialized countries (Annex 1 countries) to take credit for funding emission reduction activities in either other Annex 1 countries (joint implementation) or in developing countries (clean development mechanism). A reduction produced through these mechanisms in country X can be claimed as a reduction by country Y if country Y or one of its regulated industries has funded the activity that led to this reduction. In this chapter, we will discuss these incentive-based mechanisms, and we will also discuss a fourth program (REDD+) that is not explicitly part of the Kyoto Protocol but is sanctioned by the UNFCCC and provides incentives to developing countries (non-Annex 1) to reduce rates of deforestation.

With the replacement of the Kyoto Protocol by the Paris Agreement, these programs remain operational although their future is uncertain. This is particularly the case for the project-based programs. Still, while these programs may carry different names in the future, the structures of the new programs are likely to be quite similar to those today. Therefore, understanding their strengths and weaknesses is important as the international community decides how they will be modified with new or different names.

Emissions Trading

Emissions trading allows carbon credit trade between developed countries to meet their Kyoto obligations. The most common emissions trading program is called “cap-and-trade,” whereby a regulatory body “caps” the total number of emissions allowed within a given area, distributes emission allowances among polluting entities, and then allows these allowances to be bought and sold within the private sector. An early and quite successful cap-and-trade program was developed in the United States to reduce SO2 emissions that lead to acid rain (as allowed in the 1990 amendments to the Clean Air Act). Most emissions trading examples operate within countries, but international emissions trading was introduced as part of Kyoto to allow all countries within the trading system to contribute in different ways to the reduction of their aggregate GHG emissions.

The most important example of such a system is that of the emissions trading program of the European Union — composed of Annex 1 countries to the Kyoto Protocol. To provide incentives to reduce greenhouse gas emissions to meet their Kyoto-mandated reduction targets, the European Union (EU) developed a “cap-and-trade” system in 2005 that caps the overall amount of carbon emissions produced by large stationary emitters of GHGs in the EU (power plants and factories) and then allows these emitting companies within the EU to buy and sell carbon emission allowances among each other to achieve overall GHG emission reductions. It is now the largest carbon emissions trading program in the world. WATCH THE VIDEO BELOW AND ANSWER QUESTIONS

Source: https://youtu.be/qxdxBfZKoa0?t=39. Published on 10 Sep 2015

Clean Development Mechanism and Joint Implementation

Beyond emissions trading, two other flexibility mechanisms directly sanctioned by the Kyoto protocol allow Annex 1 countries to take credit for GHG emission reductions produced by projects that they finance in other countries. These two programs are joint implementation (JI) and the clean development mechanism (CDM). These programs are similar; the major difference is where they are implemented — JI projects are in other Annex 1 countries and CDM in developing countries (non Annex 1 countries).

Both programs install new renewable energy systems (biomass, wind, solar, hydro), improve efficiency of fossil fuel use, eliminate GHG emissions from industrial facilities, or trap the release of methane from landfills. These initiatives are funded by private industry or governments in the developed world (Annex 1), which in turn claim certified emission reductions (CERs) for the resulting net reductions in greenhouse gas emissions. The initial financing for projects can come from different sources with these sources owning the produced (offset) credits to be kept or sold.

The UNFCCC is in charge of certifying the CERs produced. These CERs can be purchased to offset emissions to meet compulsory reductions by entities in Annex 1 countries. In addition, purchases can occur voluntarily by anyone or any institution who so chooses.

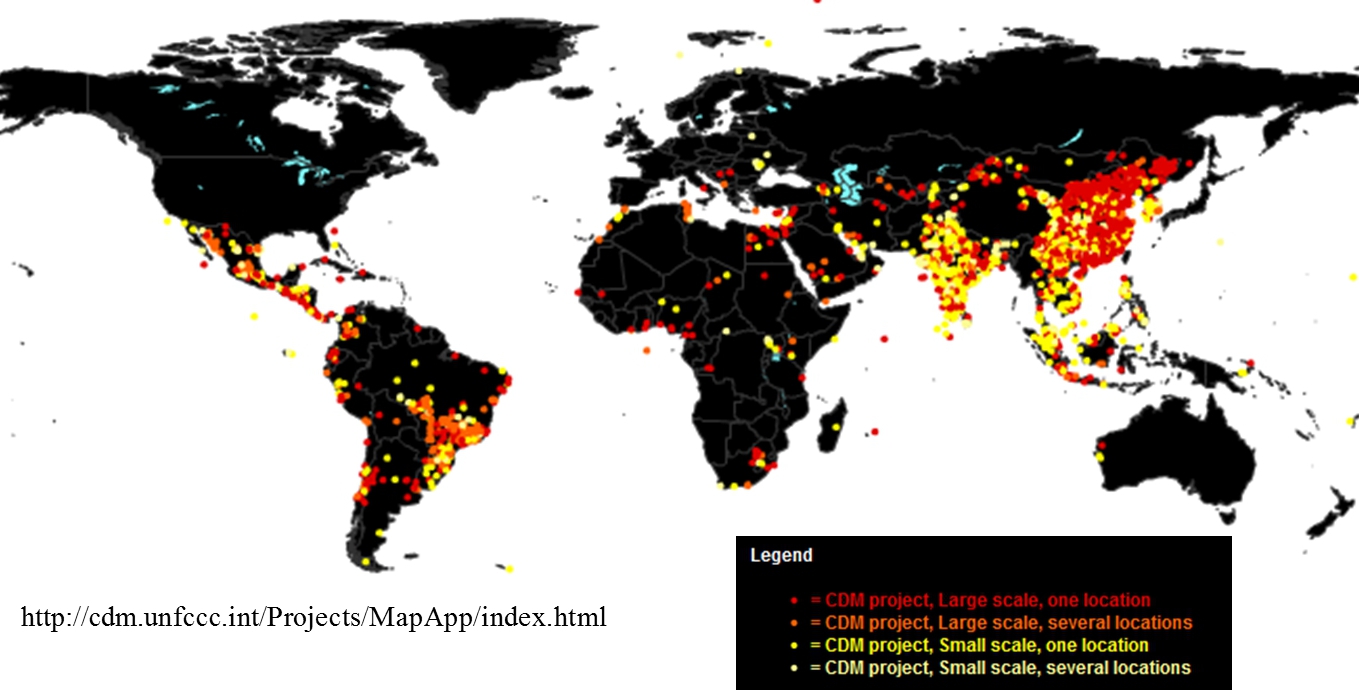

Where are these projects located? Most joint implementation projects are found in eastern Europe and the former Soviet Union — so-called “economies in transition” in Kyoto Protocol documents. The number of credits produced in JI projects are about half of CDM credits. Here is map of the location of CDM projects:

Examples of a CDM projects

Example 1: The French company Rhodia has two CDM projects in South Korea and Brazil at its factories, where the chemical adipic acid is produced (used for making nylon). Nitrous oxide, a potent GHG, is released in the process of making adipic acid. The company has invested approximately 20 milion euros in equipment that destroys the nitrous acid at the two plants. This equipment has already been installed by Rhodia and other companies in most plants within the developed world (due to environmental regulations) but Rhodia had not done so in its plants in South Korea and Brazil. As a CDM project, Rhodia receives credit for this GHG reduction of 15 million certified emission reductions expressed in CO2 equivalents (nitrous oxide is 298 times the warming potential of CO2), which can be used in its ledger in Europe (or sold on the EU exchange). In 2007, Rhodia earned approximately 280 million euros in these credits. While the price of carbon credits have declined since, these CDM projects represent a profitable investment for Rhodia — more profits than from the actual production of adipic acid itself.

Example 2: The biogas CDM Project of Bagepalli Coolie Sangha was established in 2005. It is run by a community organization of poor rural Indians (38,000 families across 900 villages). The CDM project initially planned to construct over time 5,500 biogas digesters (animal manure/organic waste + anerobic conditions = biogas composed of methane and carbon monoxide/dioxide which can be burned for cooking and water heating). The emissions benefit is the replacement of kerosene and nonrenewable wood fuel from local forests. The funding for the program was provided by the FairClimateFund, a nongovernmental organization that provides funding for small-scale pro-poor emission reduction projects. While farmers provide their labor, FairClimateFund provides resources necessary to purchase materials for digester construction and upkeep. FairClimateFund was initially paid by a French utility company for the CERs projected to be produced through the project’s first 7 years (around 1 million euros). Similar small-scale biogas programs have been operating in neighboring Nepal. A major challenge these programs face is the difficulty of monitoring and documenting the net reductions in GHG emissions that result from the proper functioning of all of the digesters. The project reportedly went well until the project area suffered significant drought from 2013-2017. This, coupled with low sales of produced CERs (due in part to slumping carbon prices in EU emission trading system), has led to a deterioration of gas production and equipment. In 2018, only 57% of the biogas digesters were still operational.

Reducing Emissions from Deforestation

and Forest Degradation (REDD+)

Another UNFCCC-sanctioned program, not formally tied to the Kyoto Protocol, REDD+, was established in 2007 (COP13). It provides funding to developing countries for the protection and better management of tropical forests. REDD+ programs seek to reduce the loss of carbon (and release as GHGs) stored in healthy tropical forests due to deforestation. As presently envisioned, the program first estimates the amount of carbon that would potentially be released into the atmosphere due to deforestation in a project area, through measurements of the amount of carbon stored in forests and current deforestation trends within the project area. This information, coupled with monitoring of the project area’s forest (on-the-ground fieldwork plus remote sensing), in theory, allow the estimation of the avoided loss of forests due to REDD+ program management. This requires significant monitoring and institutional capacity within developing countries. For this reason, the REDD+ program has built in to its structure two early “readiness” phases preceding a final implementation phase. In the “readiness” stages, countries develop a REDD+ strategy and build their capacity to implement a REDD+ mechanism (e.g. calculating forest cover baseline information; building measuring, monitoring, reporting, and verification systems, etc.). The UN’s REDD Programme provides assistance to help develop these capacities. In the implementation stage, countries implement their REDD+ strategy (i.e. a strategy to avoid deforestation over a specific period of time) and then receive results-based payments (i.e. payments for avoided deforestation) if the strategy is considered to have effectively avoided potential deforestation (again, per previous deforestation trends in the project area and measurements of carbon present in the project area’s forests). However, only a handful of developing countries have received results-based payments; most developing countries have not yet reached the full implementation phase. A goal is that the financing for results-based payments in the implementation phase will come from multilateral funding sources such as the Green Climate Fund as well as from developed countries or companies that can use the carbon credits purchased to meet their reduction obligations.

Strengths and Weaknesses of Project-Based International Incentive Programs

Project-based incentive programs such as CDM and REDD+ are evolving. Their future evolution will be shaped by efforts to address the challenges they face while seeking to maintain their advantages. The potential advantages of these programs are clear. They provide flexibility to entities in developed countries to seek opportunities outside of their own country to reduce GHG emissions at the lowest economic cost. Moreover, they can be seen as a North-South compromise by providing much needed funding to developing countries to reduce their greenhouse gas emissions. Finally, they provide benefits beyond their primary goal of GHG emission reduction. For example, REDD+, by maintaining standing forests, also protects biodiversity.

Still, these programs face challenges and are not without controversy. These challenges include:

- The challenge of additionality: An incentive program seeks to elicit behavior that would not have occurred without the incentive. The term “additionality” refers to the question of whether a program is producing actual (“additional”) changes or is simply subsidizing activities that would have occurred anyway without the incentive provided by the program. In other words: does the incentive result in an actual change, or does the incentive just pay for an activity that was likely to take place anyway. The case of the Rhodia CDM program described above is a case in point.

- The potential for leakage: Does a program lead to a displacement of GHG-producing activities outside of the program’s geographical project area? If so, the project’s reduction of GHG emissions within its action area could be misleading because these reductions are achieved from the migration, or “leakage”, of GHG producing activities outside of the project area. Leakage is most often a concern with REDD+ projects which, by restricting forest conversion in one location, may lead to greater pressure on forests elsewhere. This is why REDD+ programs have increasingly focused on reducing deforestation nation-wide, rather than in a particular area within a country.

- Time Horizon: The time horizon of the GHG emission reductions associated with a project is also a challenge. These programs require long-term compliance monitoring to ensure that changes attached to the project are not reversed in the future. A major controversy of privately-run reforestation projects producing carbon credits is they are insufficiently monitored, leading to the possibility that carbon credits could be sold with few measures to ensure that the reforested plot is deforested in the future.

- Equity Issues: When incentive programs cause a sudden increase in the value of resources (garbage, natural forests) for governments, this may result in the poor being excluded from these resources. An example is described in this article about a CDM project in India. Similarly, REDD+ projects may lead to a recentralization of forest governance to the detriment of the rural poor. For example, a government may seek REDD+ funding by claiming forested areas for the government and excluding long-time residents, who may have been using these forests sustainably.

- Sensitivity to Carbon Price: As with emissions trading, these incentive programs are sensitive to “carbon price.” In particular, funding for these programs requires entities in the developed world to pay for certified emission reductions (CERs). Given its size, the operation of the EU’s emission trading system has had a strong effect on the demand for CERs. A low price for EU emission allowances, due to a downturn in the global economy, will reduce demand for CERs. The inability of the Bagepalli Coolie Sangha CDM project to sell CERs since 2013 is due to a lack of demand from developed countries.

These ongoing challenges need to be addressed before these international incentive programs reach their potential of reducing GHG emissions without significant unintended consequences.

International Incentive Programs and the Paris Agreement

While they remain in force under the Kyoto Protocol till 2020, the future of the Kyoto flexibility mechanisms (the clean development mechanism and joint implementation) is somewhat uncertain under the Paris Agreement. COP26 was originally scheduled for 2020 in Glasgow, but it has now been postponed to Nov. 2021 due to the COVID-19 pandemic.

There is clear evidence that flexibility mechanisms will be maintained in modified form under the Paris Agreement. For example, Article 5 of the Paris Agreement specifically mentions the importance of protecting and expanding carbon sinks – particularly forests. For this reason, the Paris Agreement is supportive of the REDD+ program. As shown in the map below, the REDD+ program is mentioned in a large fraction of the INDCs of the developing countries in the tropics.

Article 6 is the most important part of the Paris Agreement with respect to the future of the market-based mechanisms, through its support of “cooperative approaches” that allow countries to use internationally transferred mitigation outcomes toward their nationally-determined contributions (NDCs), but it provides no more specific framework for doing so. Thus the language of the Paris Agreement is consistent with country X claiming credits for its funding of mitigation actions in country Y. In moving forward, Article 6 presents two market-based mechanisms:

- A country who has surpasses its Paris Agreement NDC pledge can sell its surplus achievement to another country that has fallen short of its NDC pledge. The surplus achievement could be in terms of emissions reduction, or it could be in terms of another target in a country’s pledge, like increased renewable energy capacity.

- The creation of a new UN-governed international carbon market in which public and private entities could buy and sell emissions cuts. For example, public or private entities could generate carbon credits for sale through the construction of a renewable power plant or the restoration of an area of forest, or possibly also through the inclusion of REDD+ projects. This option basically seeks to combine existing flexibility mechanisms: emissions trading, CDM, and REDD+.

Negotiations around the establishment of rules to implement these mechanisms began at COP24 in Poland but have been too complex and contentious to result in a final agreement (due to be completed by COP26). Why are Article 6 rules so controversial? There are many reasons. Here are a few. First, accurate carbon accounting turns out to be a lot more difficult than it seems. There is the risk of double counting, in which two countries claim the same reduction credit towards their emission pledges (for example, a country selling carbon credits from carbon-cutting projects could not include the carbon reduction achieved through the project as part of the country’s climate pledge). Under Kyoto, only one of the country parties to CDM and JI were required to reduce. Under the Paris Accord, all parties are expected to voluntarily reduce their emissions based on their NDCs. Thus, there is the potential for both parties to claim the reductions resulting from a joint project such as those related to CDM or JI.

Then there are the issues that we have already discussed. There is the risk of the lack of additionality of funded carbon offsets projects (as discussed earlier) if a project selling carbon credits doesn’t actually produce additional emissions reduction. For example, a carbon offsetting project selling carbon credits claims to increase carbon sequestration by using the funds to avoid deforestation at a given site but the site is located in a remote region without road access, making it unlikely that it would have experienced deforestation even without the payment. Relatedly, there is the issue of leakage: deforestation avoided at a carbon offset site might just move and take place elsewhere. Then, there is also the difficulty of ensuring permanence: carbon credits purchased today to protect Amazonian tropical rainforest cannot ensure the forest will remain protected tomorrow if Brazilian President Bolsonaro decides to do away with key national forest protection policies. There is also the controversial question of whether to allow the inclusion of Kyoto-era carbon offset units generated under the Kyoto Protocol’s Clean Development Mechanism (CDM) international carbon market. Additionally, there is the question of whether social safeguards should be included in Article 6. Critics of Kyoto Protocol’s CDM have argued that CDM projects, such as the construction of large hydropower dams, have lead to human-rights violations like the displacement of people, and thus they argue social safeguards are essential. Finally, there is disagreement over whether or how a “share of the proceeds” from carbon credit trading should be set aside and paid into an “Adaptation Fund” to support adaptation in vulnerable developing countries, particularly small-island developing states already suffering losses and damages from climate change such as sea level rise.

You are finished!

These are developed countries who under the Kyoto protocol were required to reduce their greenhouse gas emissions by a certain percentage below their 1990 emissions.

The United Nations Framework Convention on Climate Change (UNFCCC) is an international treaty to address climate change that came into force in 1994. Most all international actions to address climate change (Kyoto Protocol, Paris Agreement, REDD+) are managed under this international framework.

A group of 28 countries that operate that together act as a coordinated economic and to some extent, political block. 19 of these countries use a common currency (euro).

A financial mechanism established under the auspices of the UNFCCC in 2010. It provides funding to developing countries to adapt to climate change and reduce their greenhouse gas emissions.

Intended Nationally Determined Contributions (INDCs) outline the commitments to reduce GHG emissions and actions to achieve these goals as specified by each ratifying country to the 2015 Paris Agreement.